Cannabis in Lesotho

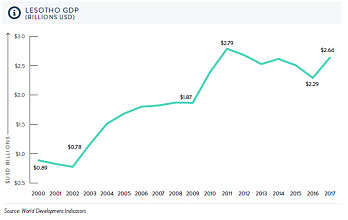

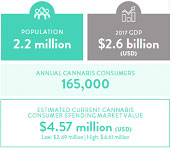

Lesotho, a small mountainous country bordered on all sides by South Africa, was the first African country to regulate medical cannabis; the govern-ment established the legal market to attract foreign direct investment and stimulate economic growth.

Lesotho suffers from high unemployment (esti-mated at 28% in 2014) and poverty rates. The economy is highly reliant on customs duties from the Southern African Customs Union (SACU), which have averaged around 26% of GDP but are highly volatile, sometimes changing by 10% of GDP year-to-year. Remittances also make up a significant proportion of GDP.

The Ministry of Health began approving can-nabis cultivation licenses in 2017, and in May 2018 the industry regulations were finalized. The cost of licenses varied depending on type of operation, with those for cultivation set at M540,000 maloti (~$38,000 USD). Compa-nies and individuals that had been issued licenses free of cost prior to the May 2018 regulations were informed that they would be required to pay the M540,000 maloti fee, and in December, Health Minister Nkaku Kabi stated that only 13 of 33 licensed companies had paid the fees. Many of the companies that had not paid had received their licenses for free before the May 2018 regulations were issued; they explained to the ministry that they were trying, but unable to pull together the money.

On March 1, 2019, the Health Ministry raised the cost of licenses to M5 million maloti (~$350,000 USD) with the stated purpose of ensuring that only businesses with the capital to participate in the industry would receive licenses. When license fee hikes were proposed by Minister Kabi in December, he was heavily criticized by several members of parliament, saying the high cost would ensure that only foreigners could operate in the industry, as the M540,000 maloti was already prohibitively high for Basotho. To meaningfully extend economic benefits to the local people, the regulations will need to be revised.

Liberalizing the regulations to allow for small-scale cannabis and hemp production can bring more direct and immediate benefits as well, for example as a low-cost and effective medicine that can be cultivated and administered in local communities to treat pain, inflammation, and high blood pres-sure, among other conditions. Palliative care is badly needed as Lesotho has the second-highest prevalence of HIV/AIDS infection, at 24% of the adult population.

Most people in Lesotho engage in subsistence farming and herding despite a lack of arable land. Food shortages are common, and most food for domestic consumption is imported from South Africa. Hemp presents a significant opportunity as a nutrient-rich and low-cost food source for humans and livestock that is heartier and less water-intensive than many other food crops.

Industrial hemp may also be able to contribute to economic growth as a raw material for the Leso-tho’s textile and garment industries, the primary source of private employment in the nation.

Cannabis Market in Africa

The last two years have seen a flurry of cannabis-related activity in Africa, including substantial foreign investment in Lesotho following the country’s regulation of medical cannabis in 2017, and the functional legalization of adult use in South Africa through the courts in 2018. In addition to those legal developments, several African countries have seen the establishment of businesses—often by or in partnership with foreign operators—which have not sought or received approval by governments to establish cannabis businesses on the continent, often angering local residents and governments.

Global interest and the pace of change will continue to accelerate, but policymakers in Africa still have choices to consider about whether to legalize cannabis, and how to design and implement regulations. However, governments must prepare now to effectively shape the medical cannabis and industrial hemp industries that they want in the future. The emergence of legal cannabis in Africa is occurring alongside several other transformative changes on the continent. Africa’s population is expected to double by 2050, to more than 2.5 billion people. Infrastructure investment is soaring, with China alone investing USD $40 billion in infrastructure and other developments in 2017 as part of its Belt and Road Initiative. The sub-Saharan construction industry is forecasted to reach $12.9 trillion USD by 2022, with much of the construction centered in East Africa..

The continent’s growth presents opportunities for both medical cannabis and industrial hemp. The plant and the industries surrounding it can support several of the UN’s Sustainable Development Goals (SDGs), including those that are highest priority for African citizens, and some of the low-tech, low-cost, accessible applications of industrial hemp can be quickly activated to support the health and growth of Africa in the coming decades.

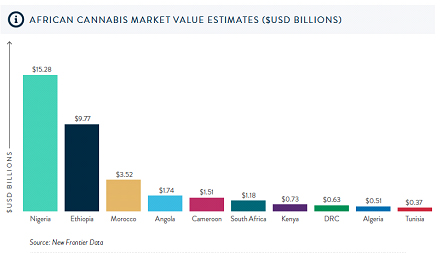

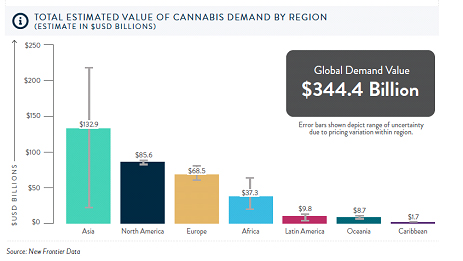

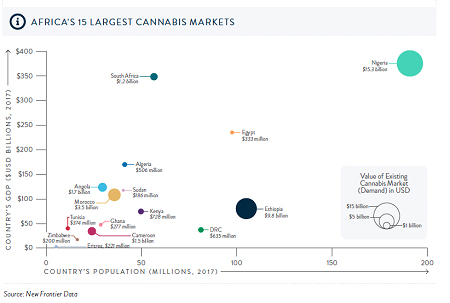

The estimates of the global market value of combined legal and illicit cannabis markets was $344.4 billion USD in 2018. Africa accounts for 11% of the world’s market value, at $37.3 billion. Africa’s most sizeable cannabis markets are those with the largest populations: Nigeria ($15.3 billion), and Ethiopia ($9.8 billion), followed by Morocco ($3.5 billion), a noted source of hash

In recent years, a few Southern African countries have begun reforming drug laws and establishing regulated cannabis industries. The first countries to do so were motivated by the economic opportunities which cannabis presented. Lesotho was the first African country to establish a legal market; the government began granting medical cannabis cultivation licenses in 2017 and issued regulations the following year. Zimbabwe followed suit, legalizing cannabis for medical and research purposes in April 2018. Then, in September 2018, South Africa’s Constitutional Court ruled that personal, private cultivation and use of cannabis was protected under the right to privacy guaranteed by its constitution. The nation’s laws are currently being revised to account for the court’s ruling. The country’s first medical cultivation license was issued in early April 2019.